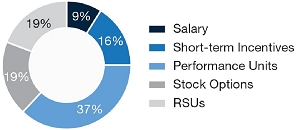

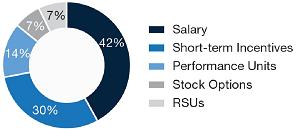

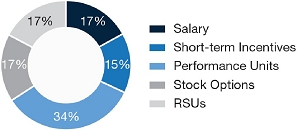

The Company’s executive compensation philosophy requires that a substantial portion of total compensation be at-risk and consist of performance-based incentives that are linked to CSX’s financial and operating results. In addition, the Committee strives to provide an appropriate balance between short and long-term incentive compensation. The mix between fixed and variable or at-risk compensation and short and long-term incentive compensation is designed to align the NEOs’ financial incentives with shareholder interests. In 2021, 72% of the CEO’s targeted Total Direct Compensation was performance-based and at-risk. The target compensation mix for each of the NEOs is shown below. In 2023, the percentage of Mr. Wallace tragically passed away in November 2021, butHinrichs’ total target compensation that was variable and at-risk was 75% and the average for the other NEOs was approximately 70%. The percentage of variable or at-risk compensation is includedcalculated as an NEO for SEC disclosure purposes since he would have been onethe sum of the next three most highly compensated executives had he remained employed through year end.target amount of short-term incentives, performance units granted and stock options granted divided by the total target compensation.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| Joseph R. Hinrichs | | James M. Foote

Sean R. Pelkey | | Kevin S. Boone | |

| | | | | | |

| President and Chief

Executive Officer | | Age 68

Tenure 4.4 years

| Responsibilities

Mr. Foote has served as President and Chief Executive Officer since December 2017. He joined CSX in October 2017, as Executive Vice President and Chief Operating Officer, with responsibility for both operations and sales and marketing. Mr. Foote has more than 40 years of railroad industry experience. Prior to joining CSX, he was President and Chief Executive Officer of Bright Rail Energy. Before heading Bright Rail, he was Executive Vice President, Sales and Marketing with Canadian National Railway Company. At Canadian National, Mr. Foote also served as Vice President – Investor Relations and Vice President Sales and Marketing – Merchandise.

|

2021 ACCOMPLISHMENTS

n | Advanced CSX’s long-term strategy through acquisitions, key growth initiatives, customer transactions and federal and state partnerships. |

| |

n | Progressed the One-CSX culture for all employees while leading the organization through a dynamic and challenging environment that included severe supply chain issues, labor shortages and an evolving political and social landscape. |

| |

n | Led the organization through safety efforts that resulted in zero fatalities. |

| |

n | Launched social justice and racial equity partnership with City Year called “10,000 Steps Towards Social Justice”, engaging employees in key communities across the rail network. |

| |

n | Ensured business continuity through hiring efforts that resulted in a 700% increase in conductor hires. |

2021 TARGET COMPENSATION

| Base Salary: | $ | 1,500,000 |

| Target Annual Bonus: | $ | 2,625,000 |

| Target Long-Term Incentives: | $ | 12,500,000 |

| Target Total Direct Compensation: | $ | 16,625,000 |

| 50% of 2021 LTI was performance-based | | |

| |

42 |  |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

| | |

| Sean R. Pelkey

Executive Vice President and Chief Financial Officer | | Age 42

Tenure 16 years

| Responsibilities

In June, 2021, Mr. Pelkey was named Vice President and Acting Chief Financial Officer. In January 2022, Mr. Pelkey was promoted to Executive Vice President and Chief Financial Officer. In this role, he is responsible for all financial aspects of the Company’s business including financial and economic analysis, accounting, tax, treasury, real estate and purchasing activities. Mr. Pelkey has more than 16 years of experience in finance, investor relations and financial planning. Since joining CSX in 2005, he has held a variety of finance management roles, including Vice President - Finance, Assistant Vice President of Capital Markets, as well as several director and managerial roles in investor relations, financial planning and IT finance.

|

2021 ACCOMPLISHMENTS

nCommercial Officer | | Added almost $200 million in value to the Company through various initiatives across all departments.

n | Assisted intermodal operations by identifying and acquiring container yards and negotiating contracts for variable storage off property. |

n | Supported the diligence and closing process for the acquisition of Quality Carriers. |

n | Realized over $500 million for real estate sales, including the multi-year Virginia transaction. |

2021 TARGET COMPENSATION

| Base Salary: | $ | 516,000 |

| Target Annual Bonus: | $ | 361,200 |

| Target Long-Term Incentives: | $ | 342,261 |

| Target Total Direct Compensation: | $ | 1,219,461 |

| 50% of 2021 LTI was performance-based | | |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

| | | | | | Kevin S. Boone

Executive Vice President – Sales & Marketing | Age 45

Tenure 4.5 years | | | | | | | | | | | | | | | | | | | Stephen Fortune | | Responsibilities

Mr. Boone has served as Executive Vice President – Sales and Marketing since June 2021. In this role, he is responsible for developing and implementing the Company’s commercial strategy. Mr. Boone previously served as

Nathan D. Goldman | | Jamie J. Boychuk | | | | | | | | | | Executive Vice President and Chief FinancialDigital & Technology Officer from October 2019 until June 2021. Mr. Boone has more than 20 years of experience in finance, accounting, mergers and acquisitions, and transportation performance analysis. He joined CSX in September 2017, as Vice President of Corporate Affairs and Chief Investor Relations Officer, and was later named Vice President - Marketing and Strategy leading research and data analysis to advance growth strategies for CSX. |

2021 ACCOMPLISHMENTS

n | | Led Sales & Marketing team that delivered $900 million in line haul revenue growth versus 2020, despite supply side constraints.

n | Increased TRANSFLO footprint by creating new terminal in Atlanta and establishing a franchise model in West Virginia. |

n | Led efforts to help East Coast ports reduce congestion at their terminals. |

n | Provided key leadership in the integration of Quality Carriers and partnered to secure incremental intermodal and chemical multi-modal volumes. |

2021 TARGET COMPENSATION

| Base Salary: | $ | 700,000 | | Target Annual Bonus: | $ | 700,000 | | Target Long-Term Incentives: | $ | 3,000,000 | | Target Total Direct Compensation: | $ | 4,400,000 | | 50% of 2021 LTI was performance-based | | |

| | 44 |  |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

| | | | Jamie J. Boychuk

Executive Vice President, – Operations | Age 44

Tenure 4.8 years | | Responsibilities

Mr. Boychuk has served as CSX Transportation, Inc.’s (“CSXT’s”) Executive Vice President – Operations since October 2019. In this role, he is responsible for transportation, mechanical, engineering and network operations. Since joining CSXT in 2017, he has held the positions of Senior Vice President of Network Engineering, Mechanical and Intermodal Operations; Vice President of Scheduled Railroading; and Assistant Vice President of Transportation Support. Mr. Boychuk previously worked at Canadian National Railway, where he served for 20 years in various operational roles of increasing responsibility.

|

2021 ACCOMPLISHMENTS

n | Led the Operations team that achieved improvements in train accident safety and the third best year of train velocity in CSX history. |

n | Responded to economic recovery and volume resurgence with subsequent increase in locomotive fleet and corresponding headcount increases. |

n | Worked with key public stakeholders towards an Amtrak Gulf Coast service solution. |

n | Led Intermodal team that opened 13 additional container yards to adapt to global supply chain challenges helping keep terminals fluid while generating supplemental revenue. |

n | Improved public safety by closing 79 at-grade crossings and eight grade separated structures. |

2021 TARGET COMPENSATION

| Base Salary: | $ | 700,000 | | Target Annual Bonus: | $ | 700,000 | | Target Long-Term Incentives: | $ | 3,000,000 | | Target Total Direct Compensation: | $ | 4,400,000 | | 50% of 2021 LTI was performance-based | | |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

| | | | Nathan D. Goldman

Executive Vice President – Chief Legal Officer and Corporate Secretary | | Age 64

Tenure 18.7 years | Responsibilities

Mr. Goldman has served asFormer Executive Vice President – Chief Legal Officer and Corporate Secretary of CSX since November 2017. In this role, he directs the Company’s legal affairs, government relations, risk management, public safety, environmental, corporate communications and internal audit functions. Mr. Goldman has previously served as Vice President of Risk Compliance and General Counsel and has overseen work in compliance, risk management and safety programs.

Operations | | | | | | | | | | | | | | | | | | | | | | |

2021 ACCOMPLISHMENTS

| n | | | | | | | | | | | | | | | | | | Supported key strategic growth initiatives (such as the acquisition of Quality Carriers and the proposed acquisition of Pan Am Systems, Inc.) with strategic communications and regulatory compliance. |

nSalary | Leveraged advanced data analytics to increase effectiveness and efficiency of audits, investigations and SOX testing. |

n | Achieved 1,000+ days injury free in CSX Police Department for first time in Company history. |

nCash-based Short-term Incentives | Successfully petitioned STB to consider adoption of an acceptable small shipper dispute resolution process. | Performance Units |

2021 TARGET COMPENSATION

| Base Salary: | $ | 550,000 | | Target Annual Bonus: | $ | 495,000 | | Target Long-Term Incentives: | $ | 2,200,000 | | Target Total Direct Compensation: | $ | 3,245,000 | | 50% of 2021 LTI was performance-based | | |

| | | 46 |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

| | | | | Diana B. Sorfleet

Executive Vice President and Chief Administrative Officer | Age 57

Tenure 10.7 years | | | Responsibilities

Ms. Sorfleet has served as Executive Vice President and Chief Administrative Officer since July 2018. In this role, she is responsible for information technology, human resources, labor relations, people systems and analytics, medical, total rewards and aviation. She joined the Company in 2011, and has previously served as Chief Human Resources Officer. Prior to joining CSX, she served as vice president for diversity and development at Exelon, one of the nation’s leading competitive energy providers.

|

2021 ACCOMPLISHMENTS

nNon-qualified Stock Options | Drove productivity, efficiency, safety and customer service through technology solutions that included new ShipCSX tools, and autonomous inspection analytics. |

n | Completed multiple security assessments to baseline the Company’s security posture and reduce risk. |

n | Advanced culture change initiatives in support of CSX’s business strategy and supported launch of social justice and racial equity partnerships. |

n | Expanded employee hiring, training and development opportunities to support business results. Hiring included over 1,000 conductors in 2021.Restricted Stock Units |

2021 TARGET COMPENSATION

| Base Salary: | $ | 550,000 | | Target Annual Bonus: | $ | 495,000 | | Target Long-Term Incentives: | $ | 2,200,000 | | Target Total Direct Compensation: | $ | 3,245,000 | | 50% of 2021 LTI was performance-based | | |

| | | | | | 20222024 Proxy Statement | 4770 |

Compensation Discussion and Analysis | Compensation Decisions Table

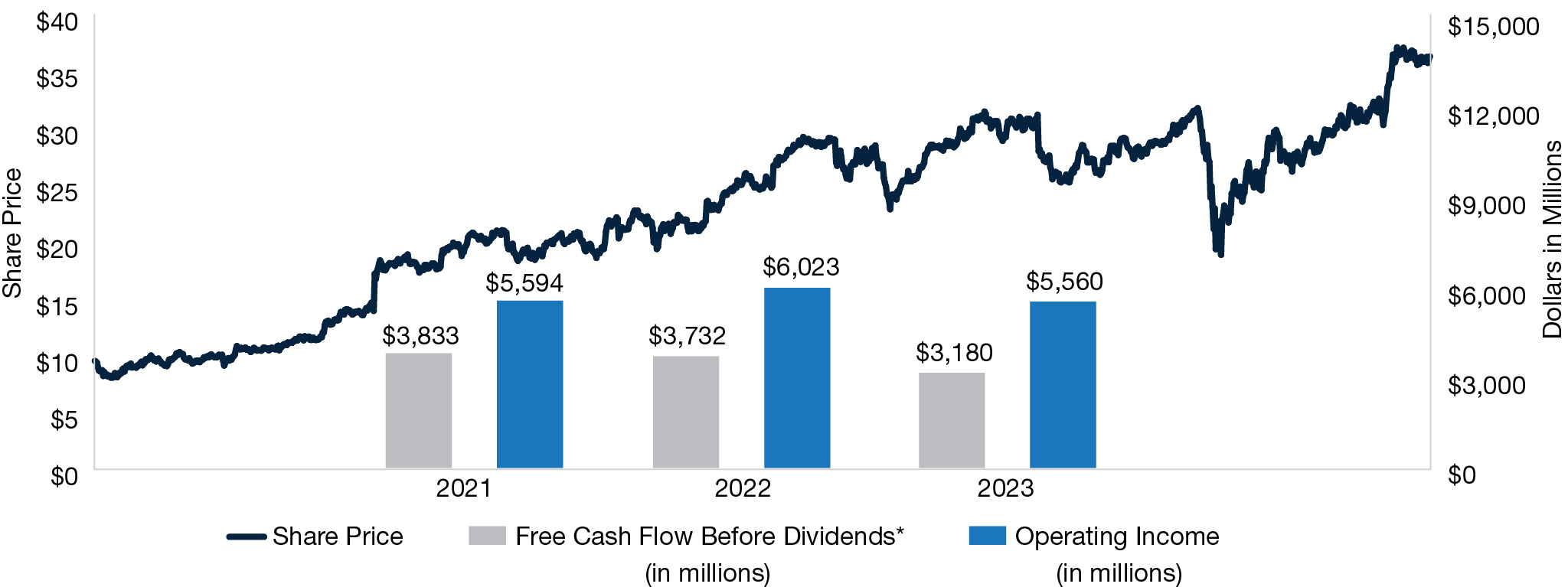

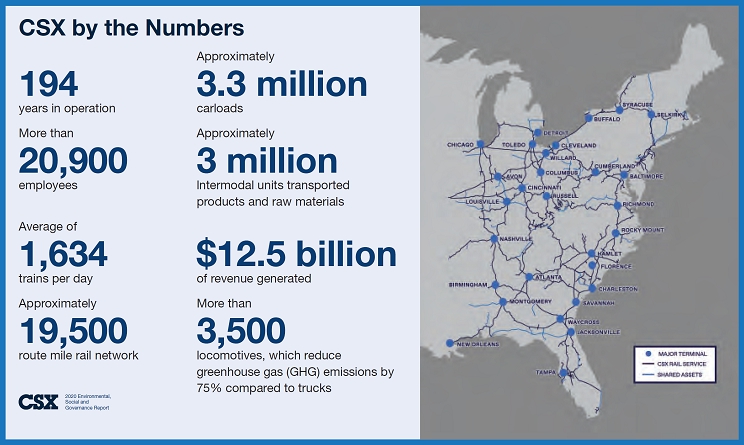

2023 Compensation Decisions CSX provides competitive total compensation opportunities in line with similar Comparator Group companies with a focus on pay-for-performance and shareholder value creation. All compensation decisions for the CEO are made by the non-management members of ContentsCOMPENSATION DISCUSSION AND ANALYSIS

2021the Board, and all compensation decisions for the other NEOs are made by the Committee in consultation with the CEO. This rigorous review process is designed to ensure that executive compensation reflects considerations based on market practice, internal equity and the business needs of CSX.

In September 2022, the Board appointed Mr. Hinrichs as President and CEO to continue driving the Company’s growth and delivering for our shareholders, based on his proven and relevant track record around operational excellence, serving customers and building a company culture of trust and strong employee engagement. The Committee approved an overall compensation package for Mr. Hinrichs intended to strike the appropriate balance of fairly compensating him relative to peers, the Comparator Group and other S&P 500 CEOs, while aligning with shareholder expectations. To better demonstrate and provide support for our 2023 compensation decisions, the scorecards below include biographical information and career highlights for each NEO, along with their respective 2023 accomplishments and an overview of their actual compensation. Unlike the charts above, which show the target compensation mix for each of the NEOs, the actual compensation charts below include 2023 base salary earnings, 2023 MICP payouts based on Company and individual performance and long-term incentives (“LTIs”) granted in 2023. The percentage of LTIs that is performance based is calculated by the amount of performance units granted divided by the total LTI awards granted.

Compensation Discussion and Analysis | Compensation Decisions | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Joseph R. Hinrichs, 57 President and Chief

Executive Officer Tenure 1.5 years | | | | | Sean R.

Pelkey, 44 Executive Vice President and Chief Financial Officer Tenure 18.7 years | | | | | | | | | | | | | Responsibilities | | | Responsibilities | | Mr. Hinrichs joined CSX in September 2022 as President and Chief Executive Officer. Mr. Hinrichs has more than 30 years of experience in the global automotive, manufacturing operations and energy sectors. Prior to joining CSX, he served as President of Ford Motor Company’s automotive business. He began his career with General Motors in 1989 as an engineer and quickly ascended into management. Between management roles at Ford and General Motors, Mr. Hinrichs oversaw investments in small entrepreneurial businesses for Ryan Enterprises, a private equity firm. Mr. Hinrichs brings to CSX a commitment to operational excellence, experience building global businesses through investment in people and culture and a deep understanding of balancing safety and efficiency in a complex industry. | | | Mr. Pelkey was named Vice President and Acting Chief Financial Officer in June 2021, and promoted to Executive Vice President and Chief Financial Officer in January 2022. In this role, he is responsible for all financial aspects of the Company’s business, including financial and economic analysis, accounting, tax, treasury and purchasing activities. Mr. Pelkey has more than 18 years of experience in finance, investor relations and financial planning. Since joining CSX in 2005, he has held a variety of finance management roles, including Vice President – Finance and Assistant Vice President of Capital Markets, as well as several director and managerial roles in investor relations, financial planning and IT finance. | | 2023 Accomplishments | | | 2023 Accomplishments | | nAdvanced ONE CSX culture, including implementing recurring employee engagement surveys, holding all-employee quarterly town halls, supporting Business Resource Groups (BRGs) and increasing employee participation in community and CSX-sponsored events. Results include an increase in the CSX employee trust score, Glassdoor improved rankings and being named one of America’s Greatest Workplaces for Diversity by Newsweek and Best Place to Work for Disability Inclusion by Disability:IN. nDrove strategies to create long-term and profitable business, including merchandise, intermodal initiatives, TRANSFLO and completion of the integration of Pan Am. nDrove operational improvements including Total Trip Plan Compliance YoY improvement of 20%, Network Velocity YoY improvement of 12%, Network Dwell YoY improvement of 17% and Customer Switch Performance YoY improvement of 12%. nLowest number of personal injuries among the Class I railroads but reaffirmed the need to further enhance safety training and diligence for all employees in light of three employee fatalities in 2023. nSuccessfully negotiated leading edge paid sick time benefits policies for employees who are covered under a collectively bargained agreement. | | | nDelivered $220 million of direct value across departments, including tax and insurance program efficiencies, interest rate swaps and procurement activities on goods and services. nFacilitated a working team towards the production of hydrogen locomotives at our Huntington location and secured a deal to operate battery-electric locomotives at our Port of Baltimore location. nRepositioned cash during the regional banking scrutiny to mitigate CSX risk, along with extending the Company’s credit facility for another five years to ensure access to liquidity if needed during highly disruptive events. nHelped foster a more cohesive ONE CSX culture within the Finance organization and the broader Company through a series of strategic grassroots initiatives aimed at increasing collaboration, employee development and community involvement. | | 2023 Actual Compensation | | | | 2023 Actual Compensation | | | | | | | Base Salary: | | | $ | 1,400,000 | | | | Base Salary: | | | $ | 660,000 | | | Annual Bonus Earned: | $ | 2,415,000 | | | | Annual Bonus Earned: | $ | 759,000 | | | Long-Term Incentives Granted: | $ | 10,000,035 | | | | Long-Term Incentives Granted: | $ | 2,325,019 | | | Total Actual Compensation: | $ | 13,815,035 | | | | Total Actual Compensation: | $ | 3,744,019 | | | 60% of 2023 LTIs granted were performance based | | | 60% of 2023 LTIs granted were performance based |

Compensation Discussion and Analysis | Compensation Decisions | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Kevin S.

Boone, 47 Executive Vice President and Chief Commercial Officer Tenure 6.5 years | | | | | Stephen

Fortune, 54 Executive Vice President and Chief Digital & Technology Officer Tenure 2.0 years | | | | | | | | | | | | | Responsibilities | | | Responsibilities | | Mr. Boone has served as Executive Vice President and Chief Commercial Officer since June 2021. In this role, he is responsible for developing and implementing the Company’s commercial strategy. Mr. Boone previously served as Executive Vice President and Chief Financial Officer from October 2019 until June 2021. Mr. Boone has more than 20 years of experience in finance, accounting, mergers and acquisitions and transportation performance analysis. He joined CSX in September 2017, as Vice President – Corporate Affairs, and was later named Vice President – Sales & Marketing leading research and data analysis to advance growth strategies for CSX. | | | Mr. Fortune joined CSX in April 2022 as Executive Vice President and Chief Digital & Technology Officer. Mr. Fortune is responsible for leading CSX’s technology strategy development and implementation and supporting business growth through innovative digital solutions, as well as overseeing all aspects of the Company’s information technology systems operations. Mr. Fortune brings decades of experience as a corporate technology leader. Prior to CSX, he served 30 years at BP, most recently as Chief Information Officer of the global BP Group. He began his BP career as a chemical and process engineer before moving into operations management and transitioning into information technology in 2003. | | 2023 Accomplishments | | | 2023 Accomplishments | | nExceeded total revenue plan, including growing line-haul revenue by almost $500 million, despite international headwinds impacting the Company’s export coal rates and international intermodal volume. nSignificant wins across multiple lines of business, including TRANSFLO, Westrock, LyondellBasell, multiple LPG customers, multiple automotive manufacturers and domestic intermodal partners. nTDSI AAR audit scores continue to remain high, including leading the industry at destination ramps with an almost perfect score. nFocused on leadership and skill development of the Sales and Marketing organization and support of organizational ONE CSX initiatives. | | | nRealigned strategy for the modernization of the CSX technology vision, placing the employee and customer at its core, and guided by the central focus on safety, which includes the five-year effort to replace the mainframe-based Core Dispatch system and updated tablets for the Company’s train and engine employees. nIn partnership with Sales and Marketing, transformed the ShipCSX tool with new tools that make it easier for customers to do business with CSX, in addition to introducing a user-friendly coal reservation system, Intermodal Time on Terminal tool, tracking Car Order Fill, and Automotive Supply performance tools. nFocused on proactive measures to increase cybersecurity awareness within CSX, including the implementation of robust security measures and threat partner mitigation. nLaunched the Train and Engine Portal and upgraded technological devices, significantly improving operational efficiency and creating a more collaborative ONE CSX employee work experience. | | 2023 Actual Compensation | | | | 2023 Actual Compensation | | | | | | | Base Salary: | | | $ | 725,000 | | | | Base Salary: | | | $ | 650,000 | | | Annual Bonus Earned: | $ | 833,750 | | | | Annual Bonus Earned: | $ | 747,500 | | | Long-Term Incentives Granted: | $ | 3,150,014 | | | | Long-Term Incentives Granted: | $ | 2,325,019 | | | Total Actual Compensation: | $ | 4,708,764 | | | | Total Actual Compensation: | $ | 3,722,519 | | | 60% of 2023 LTIs were performance based | | | 60% of 2023 LTIs granted were performance based |

Compensation Discussion and Analysis | Compensation Decisions | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Nathan D. Goldman, 66 Executive Vice President, Chief Legal Officer and Corporate Secretary Tenure 20.7 years | | | | | | | | | | | | | | | | | | Responsibilities | | | | | Mr. Goldman has served as Executive Vice President, Chief Legal Officer and Corporate Secretary of CSX since November 2017. In this role, he directs the Company’s legal affairs, government relations, risk management, public safety, environmental and internal audit functions. Mr. Goldman has previously served as Vice President of Risk Compliance and General Counsel and has overseen work in compliance, risk management and safety programs. | | | | | 2023 Accomplishments | | | | | | | | | | Jamie J. Boychuk, 46 Former Executive Vice President – Operations Tenure 6.2 years | | nSupported development of key sustainability initiatives and ESG reporting, including biodiesel testing, hydrogen locomotive design and build and securing a grant for electric locomotives. nPartnered with communities to win an industry-leading $2.6 billion in public funding for projects which will increase safety, capacity, connectivity and efficiency. nIncreased first responders training and outreach to touch a total of 4,800 external partners during over 70 events to ensure readiness in the event of a community incident. nEngaged in a number of internal and external initiatives and programs targeted at strengthening ONE CSX communities. | | | | | | | | | | | | | Responsibilities | | | | Mr. Boychuk was involuntarily separated without cause from his position as Executive Vice President – Operations of CSX Transportation, Inc. (“CSXT”) in August 2023. | | 2023 Actual Compensation | | | | 2023 Actual Compensation | | | | | | | | Base Salary: | | | $ | 570,000 | | | | Base Salary: | | | $ | 433,424 | | | Annual Bonus Earned: | $ | 589,950 | | | | Annual Bonus Earned: | $ | 498,438 | | | Long-Term Incentives Granted: | $ | 2,325,019 | | | | Long-Term Incentives Granted: | $ | 3,150,014 | | | Total Actual Compensation: | $ | 3,484,969 | | | | Total Actual Compensation: | $ | 4,081,876 | | | 60% of 2023 LTIs granted were performance based | | | 60% of 2023 LTIs granted were performance based. Base salary and annual bonus earned are prorated based on the partial year of service; LTIs reflect the full amount granted but will prorate based on the partial year of service. |

Compensation Discussion and Analysis | Compensation Decisions 2024 Compensation Decisions In February 2024, the Board reviewed the compensation levels for Mr. Hinrichs and, based on this review, determined that increases to his annual base salary, target annual bonus opportunity and target long-term incentive opportunity were appropriate. As a result, on February 16, 2024, the Board approved a base salary increase from $1,400,000 to $1,500,000, a target annual bonus opportunity increase from 150% of base salary to 175% of base salary and a target long-term incentive opportunity increase from $10,000,000 to $11,400,000. In addition, the Board approved an increase in the annual cap on the aggregate incremental cost to the Company of Mr. Hinrichs’ personal use of corporate aircraft that will be covered by the Company from $175,000 to $250,000. When the Board appointed Mr. Hinrichs as President and CEO in September 2022, the Board set Mr. Hinrichs’ compensation at a level intended to compensate him fairly, while also acknowledging that he was new to the rail industry and aiming to provide a runway with him to increase his compensation over time, as warranted. Specifically, the Board anticipated that if Mr. Hinrichs performed in a manner commensurate with the Board’s hopes and expectations and was able to make measurable progress on some of the Company’s key strategic goals, including (i) building and improving the overall CSX culture and morale among employees, (ii) increasing service levels and customer engagement and (iii) continuing the Company’s efforts to increase safety, then the Board would want to increase his compensation over time. The Board believes that improvements in these areas, while continuing the Company’s operational excellence, will unlock additional opportunities for CSX and increase its competitiveness and shareholder value over the long term. Over his first 18 months at CSX, Mr. Hinrichs has exceeded the Board’s expectations in virtually all of these areas. nMr. Hinrichs has truly transformed the Company’s culture. He has championed the ONE CSX culture by actively engaging on the ground with employees and advancing cultural changes. This has resulted in significant improvement in employee engagement and satisfaction, and Company culture has gone from being a pain point to an area of great pride. nMr. Hinrichs has led negotiations to make CSX the first U.S. railroad to come to agreement with unions to provide paid sick leave to union employees of certain crafts—a critical step in preventing a nationwide railroad strike—and is continuing to lead the industry for the next round of collective bargaining set to kick off later this year. nFrom a service perspective, Mr. Hinrichs has supported CSX becoming an industry leader in service. Under his leadership in just the first year of his tenure, the Company has the best and, importantly, most consistent level of service to its customers as reflected in nearly every customer service metric in the industry. With Mr. Hinrichs as our President and CEO, CSX was the first railroad to be released from Surface Transportation Board (STB) reporting of certain of these metrics. nOn safety, CSX has been one of the leaders among Class I railroads with the lowest number of injuries in 2023 and the second lowest train accident rates in an environment where the Company was training over 2,000 new train and engine service employees. Unfortunately, rail is an inherently dangerous industry and there have been some challenges, including three fatalities in 2023. The Board believes that the changes in culture described above and Mr. Hinrichs’ commitment to improving safety at all levels and decision to bring on an industry veteran Chief Operating Officer, Michael A. Cory, will yield improvement to the Company’s safety record. Moreover, these goals were achieved on top of continued strong financial performance, with CSX outperforming most rails (all but Canadian Pacific Kansas City Limited) on revenue growth in 2023. The Board believes that the foundational changes that Mr. Hinrichs has been able to implement will make CSX stronger and more successful over the long term, and the Board believes that it is in the Company’s best interests to recognize and reward him for his work thus far and continue to incentivize him over the coming years. Notably, most of the increases in compensation provided to Mr. Hinrichs are in the form of performance-based compensation, and so Mr. Hinrichs will only experience these increases if the Company continues to meet or exceed its financial and operational goals.

Compensation Discussion and Analysis | 2023 Base Salary 2023 Base Salary The Committee determines a base salary for the CEO and each NEO annually based on its assessment of the individual’s scope of responsibilities, performance and experience. The Committee also considers salary data for similar positions within the Comparator Group. After considering this information and in light of the economic environment, the Committee made the following adjustments for certain NEOs. Base salary may represent a larger or smaller percentage of total compensation actually paid, depending on whether actual Company and individual performance under the short and long-term incentive plans discussed herein fall short of or exceed the applicable performance targets. In 2021,2023, the Committee reviewed the annual compensation of the Company’s NEOs and approved, or recommended Board approval forin connection with the CEO, changes to base salaries that consideredreflected the consideration of market data, individual performance, overall responsibilities, internal equity and functional experience. For Mr. Foote, In January 2023, the Committee recommended, and the Board approved an increase to his annuala base salary to $1,500,000. The Committee approved increases to the base salariesincrease for Mr. Boone, Executive Vice President – Sales and Marketing (EVP - CFO at the time of approval), Mr. Boychuk, Executive Vice President – Operations, Mr. Goldman, Executive Vice President – Chief Legal Officer and Corporate Secretary, Ms. Sorfleet, Executive Vice President and Chief Administrative Officer, and Mr. Pelkey, Executive Vice President and Chief Financial Officer, (Vice Presidentto $660,000, based on performance, achievement of his 2022 goals and Acting Chief Financial Officer atpositioning within the time of approval). The new base salaries were as follows: Messrs. Boone and Boychuk – $700,000; and Mr. Goldman and Ms. Sorfleet - $550,000. These adjustments wereComparator Group. This adjustment was effective as of January 1, 2021. In June 2021, the Committee approved2023. The CEO and no other NEOs received a base salary increase in 2023. | | | | | | | | | | | | | | | | NEO | 2023 Annual Base Salary | Changes from 2022 | Reasons for Changes | | Joseph R. Hinrichs | | $ | 1,400,000 | | — | % | No change from 2022 | | Sean R. Pelkey | | $ | 660,000 | | 10 | % | Due to performance, achievement of his 2022 goals and positioning within the Comparator Group | | Kevin S. Boone | | $ | 725,000 | | — | % | No change from 2022 | | Stephen Fortune | | $ | 650,000 | | — | % | No change from 2022 | | Nathan D. Goldman | | $ | 570,000 | | — | % | No change from 2022 | | Jamie J. Boychuk | | $ 725,000* | — | % | No change from 2022 |

* Mr. Boychuk was involuntarily separated without cause under circumstances that made him eligible for Mr. Pelkey of $516,000severance benefits under the Company’s executive severance plan in connection with his promotion to Vice President and Acting Chief Financial Officer.2021 August 2023. His actual base salary paid in 2023 was $433,424.

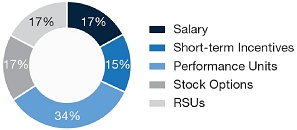

Short-Term Incentive Compensation Goal Setting Process for 2021the 2023 MICP In January 2021,2023, the Committee established and approved the goalsmeasures and measurestargets under the 20212023 Management Incentive Compensation Plan (the “2021 MICP”)(MICP) and developed a performance structure to drive business results and create value for shareholders. The 2021 MICP was designed to deliver results that drive profitability, improve safety, enhance customer service and grow revenue, while optimizing assets and controlling costs. In addition to the safetyfinancial and customer service goals, the Committee included an ESG-focused measuremeasures related to safety and fuel efficiency which can helpin the Company and customers reduce carbon emissions.plan. The 2021Committee established the following target 2023 MICP incentive opportunities (“Target Incentive Opportunity”) for each NEO. | | | | | | | NEO | Target Incentive Opportunity

(% of Base Salary) | | Joseph R. Hinrichs | 150 | % | | Sean R. Pelkey | 100 | % | | Kevin S. Boone | 100 | % | | Stephen Fortune | 100 | % | | Nathan D. Goldman | 90 | % | | Jamie J. Boychuk* | 100 | % |

* Mr. Boychuk was involuntarily separated without cause under circumstances that made him eligible for severance benefits under the Company’s executive severance plan in August 2023. His actual 2023 MICP payout was prorated to reflect his partial year of service. The 2023 MICP was structured to reward executives and eligible employees for driving Company performance over a one-year period. Each NEO was provided an incentive opportunitya Target Incentive Opportunity based on the goals established by the Committee expressed as a percentage of base salary earned during the year (“Target Incentive Opportunity”).and positioning of similar roles in the Comparator Group. In 2021,2023, the Target Incentive Opportunity level for Mr. FooteHinrichs was 175%150% of base salary, 100% of base salary for Messrs. Boone, Boychuk, Fortune and Wallace,Pelkey and 90% of base salary for Ms. SorfleetMr. Goldman. The Target Incentive Opportunity levels for Messrs. Hinrichs, Boone, Boychuk, Fortune and Mr. Goldman and 70%remained the same as in 2022. The increase in the Target Incentive Opportunity of 90% to 100% for Mr. Pelkey.2021Pelkey was driven by the responsibilities of his role and the positioning of similar roles in the Comparator Group.

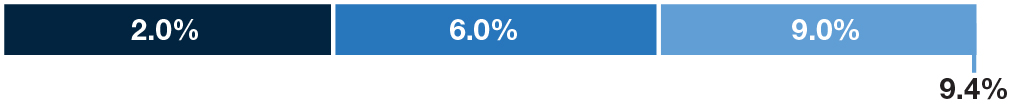

Compensation Discussion and Analysis | Short-Term Incentive Compensation 2023 MICP Performance Measures In January 2021,2023, the Committee approved the performance measures for the 20212023 MICP, which included financial performance measures, safety improvement,and operational, customer service and ESG-related targets.measures of safety and fuel efficiency. The financial measures account for 70% of the MICP’s overall weighting. These measures have proven to bebeen critical drivers of CSX’s business success. In an effort to enhance focus on sustainable growth, theThe Committee approved weightings for each of the performance measures as set forth below.  | | Operating Income | | Directly tied to Operating Ratio targets and gauges the general health of the core business – quantifying our profitability. |  | | Operating Ratio | | A key indicator of the Company’s efficiency, this measure helps us maintain focus on maximizing the value of our service product, as well as ensuring that our processes are safe and cost efficient, which are main themes of our guiding principles. |  | | Safety | | FRA Personal Injury and Train Accident rates underscore the critical importance of intensifying our focus on injury and accident prevention. |  | | Trip Plan Compliance | | Trip Plan Compliance is a measure of successfully executing the trip plan for freight cars (including lntermodal) based on commitments to our customers. |  | | Fuel Efficiency | | Fuel Efficiency measures our fuel productivity using gallons of fuel divided by gross ton miles. |  | | Initiative-based Revenue Growth | | Initiative-based Revenue Growth measures our ability to gain new business. |

| | 48 |  |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

To determine the payout under the MICP, the Committee first assesses the Company’s performance against each of the goals for the year. These Company performance measures can result in a payment between 0% and 200% of the NEO’s Target Incentive Opportunity. In addition, upward Upward or downward payout adjustments may be made based on a determination of exceptional individual performance.performance; however, no individual performance adjustments were applied to 2023 payouts for any NEO. The individual performance modifier has been a standard component of the MICP design for over 10 years. Last year, after the voting results of our 2022 “Say-on-Pay” proposal and intensive shareholder outreach and engagement efforts focused on our executive compensation program, the Committee re-evaluated the circumstances under which individual performance adjustment(s) might be appropriate and determined that such circumstances should be exceptional. To build on that commitment, the Committee recently enhanced the rigor around the review process—through which the Committee determines payout adjustments—to ensure that such process evaluates truly exceptional achievement against pre-established performance goals set at the beginning of the year, as well as other outstanding accomplishments that impact shareholder value creation, our customers and employee culture. No individual performance adjustments were applied to 2023 payouts for any NEO. Upward payout adjustments for each of the NEOs are capped at 150% of the Company’s MICP payout, with a maximum total payout under the MICP of 250% of the NEO’s Target Incentive Opportunity. If the Committee believes that any instance of adjustment is merited—upward or downward—fulsome and specific disclosure of how compensation decisions are tied to goals and performance will be provided. As shown in the Summary“Summary Compensation Table,,” the 20212023 MICP payouts reflectwere based solely on the Company’s financial and operational performance. 2021

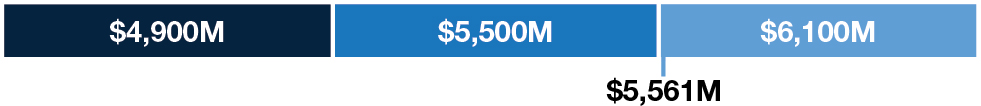

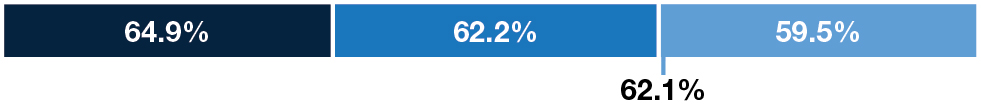

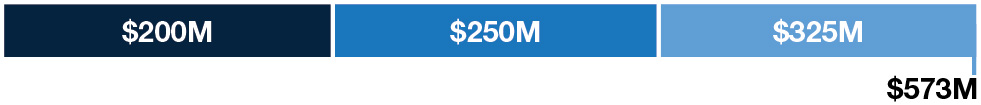

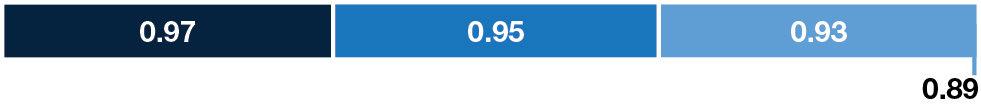

2023 MICP Targets and Payout Percentages In light of the continuing economic uncertainties and widespread supply chain challengeshigh inflation that existed in January 2021,2023 when the plan2023 MICP was adopted, the Committee approved annual incentive targets reflective of the challenging economic environment and with a wider performance range than recent years. The 2021 MICP was designed tothat would continue to build on the Company’s strong customer service levels to createand drive new business opportunities and drive revenue growth. As such, the 2023 MICP operating income target was set $523 million below the 2022 MICP operating income actual. The Committee believesCompany was cycling $238 million of prior year real estate gains and expected a normalizing supply chain environment to result in reduced intermodal storage revenue as well as lower export coal pricing. The Company disclosed that, sustained improvements inas expected, actual 2023 results were impacted by the prior year Virginia real estate transaction, declining intermodal storage revenue and lower export coal benchmarks, totaling nearly $700 million of operating efficienciesincome impact on a combined basis.

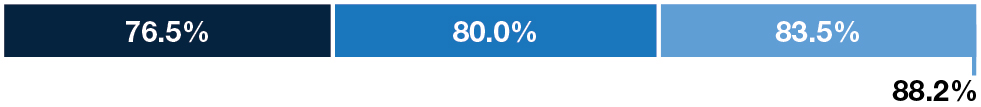

Compensation Discussion and the focus on growth will continue to play a critical role in the continued creation of shareholder value. Analysis | Short-Term Incentive Compensation The specific threshold, target and maximum payout goals and applicable weighting for each performance measure isare set forth in the table below. | Performance Measure1 | | Weighting | | | Threshold1 | | Target | | Maximum | | Financial Goals – 60% | | Operating Income | | 30% | | $ | 3,800M | | $ | 4,540M | | $ | 4,830M | | Operating Ratio2 | | 30% | | | 61.5% | | | 58.8% | | | 57.2% | | Initiative-based Revenue Growth | | 10% | | $ | 150M | | $ | 200M | | $ | 275M | Operational and ESG Goals – 30%

(Customer Service, Environment & Growth) | | Trip Plan Compliance | | 10% | | | 80% | | | 82.5% | | | 85% | | Fuel Efficiency | | 10% | | | 1.03 | | | 0.98 | | | 0.95 | | FRA Personal Injury Rate | | 5% | | | 0.99 | | | 0.90 | | | 0.85 | | FRA Train Accident Rate | | 5% | | | 2.65 | | | 2.40 | | | 2.35 | | Total Payout Opportunity | | | | | 2.5% - 50%1 | | | 100% | | | 200% |

| | 1 | Performance measure payouts are independent and could result in a threshold payout range from 2.5% to 50%. | 2 | The 2021 MICP allowed a formulaic adjustment to the operating ratio performance goal by a pre-determined amount if the average cost of highway diesel fuel was outside the range of $2.25 to $2.75 per gallon. This adjustment is designed to account for the potential impact that volatile fuel prices have on expenses and operating ratio. Because the 2021 average price per gallon was $3.28 for highway diesel fuel, which was outside the top end of the range, the operating ratio goals were adjusted as follows: threshold of 62.1%, target of 59.4% and maximum of 57.8%. |

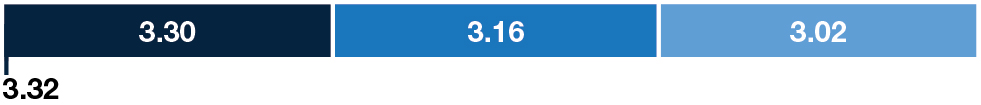

The Committee believes that the measures for the 2021 MICP were directly aligned with the Company’s strategic short-term goals, wereare directly impacted by executive leadership actions, supported our long-term strategy, helped deliver shareholder value and ensured retention of critical talent. For 2021,The following table demonstrates the Company achieved above-maximum operating income of $5.594 billionCompany’s 2023 achievements against each target and above-maximumthe overall resulted payout. | | | | | | | | | | | | | | | | | | | | | | | | | | | Performance Measure(1) | Threshold(1) (0% – 50% payout) | Target

(100% payout) | Maximum

(200% payout) | Individual Measure Payouts | | Resulted Company Payout | | Total Payout for All NEOs | | Financial Goals – 70% weighting | | | | | | | Operating Income (30% weighting) | | 33% | | | | | Operating Ratio(2) (30% weighting) | | 32% | | | | | Initiative-based Revenue Growth(3) (10% weighting) | | 20% | | 115% | | 115%(5) | ESG (Safety and Environmental) and Operational Goals(4) – 30% weighting | | | | | FRA Personal Injury Rate (5% weighting) | | 10% | | | | FRA Train Accident Rate (5% weighting) | | 0% | | | | | | Trip Plan Compliance (10% weighting) | | 20% | | | | | | Fuel Efficiency (10% weighting) | | 0% | | | | |

(1)Performance measure payouts are determined independently and each measure could result in a threshold payout range from 0% to 50% as shown, where applicable, in the table. (2)The 2023 MICP allowed a formulaic adjustment to the operating ratio performance goal by a predetermined amount if the average cost of 55.3%. FRA Personal Injuries were slightly below target at 0.92, while FRA Train Accidents fell below threshold at 2.90. Forhighway diesel fuel was outside the Operationalrange of $4.00 to $4.50 per gallon. This adjustment is designed to account for the potential impact that volatile fuel prices have on expenses and ESG goals,operating ratio. Because the Company achieved: 76.5% trip plan compliance,2023 average price per gallon was $4.21 for highway diesel fuel, which was below threshold;within the range, there was no adjustment to the operating ratio goals. (3)Initiative-based Revenue Growth is a non-GAAP measure calculated by the amount of newly generated line-haul revenue associated with specific customer initiatives in the year. Line-haul revenue is the revenue generated from moving traffic, excluding fuel efficiencysurcharge, before any costs or expenses are deducted. (4)Certain safety actuals and operations performance can continue to settle over time. The Company’s 2023 achievements demonstrated in this table reflect actuals as of 0.960, which was just below maximum; and $341 million of initiative-based revenue growth, which was well ahead of maximum. As such,around the Company’stime the Committee approved the overall resulted payout in early 2024. (5)No individual performance on each of these goalsadjustments were applied to 2023 payouts for 2021, resulted in a payout of 160% of target incentive opportunities.Similar to how management evaluates the performance of all eligible employees, theany NEO.

The Committee annually assesses the individual performance of each NEO and determines payout amounts, which wereare capped at the maximum Company payout of 250% of target for 2021.2023. Based on the 20212023 accomplishments for each NEO as described above, the Committee did not exercise its discretion to make upward or downward payout adjustments based on individual performance for any NEO, and approved a 160%115% total annual incentive payout for each of the NEOs other than Mr. Foote. For Mr. Foote, the Committee recommended, and the Board approved, a 200% annual incentive payout, which included a 25% upward adjustment based on individual performance.the 115% resulted Company payout. These payouts are reflected in the “Non-Equity Incentive Plan Compensation” column of the Summary“Summary Compensation Table.2022 Proxy Statement 49

Table.” Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

2022 MICP2024 Management Incentive Compensation Plan Design The 2022 MICP2024 Management Incentive Compensation Plan (MICP) design continues to emphasize financial, safety, operating income and operating ratio, as well as operational and ESG-focusedenvironmental performance measures including trip plan compliance (a customer service measure), fuel efficiency and initiative-based revenue growth. These measures are designed to enhance focus on items that employees have the ability to directly influence, align to shareholder expectations and support the One-CSXONE CSX strategy. The goalOperating margin replaced operating ratio to support the Company’s continued focus on profitable growth while emphasizing the importance of cost control and asset utilization. In addition, in furtherance of the One-CSX strategy isCommittee’s commitment to promote a culture that positionsenhance the Company torigor around its MICP review process, the 2024 MICP includes pre-established individual performance goals against which adjustments for exceptional performance and outstanding accomplishments will be an employer of choice to attractdetermined.

Compensation Discussion and retain the best talent and assure that every employee understands and delivers on strategic priorities.Analysis | Long-Term Incentive Compensation Long-Term Incentive Compensation The Company’s long-term incentive compensation program is intended to: ■ | Engage and reward employees for extraordinary results that will maximize shareholder value; | ■ | Reinforce a pay-for-performance culture with a significant portion of total compensation at risk; and | ■ | Align NEO interests with those of shareholders with a focus on generating sustainable performance over a multi-year period. |

nengage and reward employees for extraordinary results that will maximize shareholder value; nreinforce a pay-for-performance culture with a significant portion of total compensation at-risk; and nalign NEO interests with those of shareholders, with a focus on generating sustainable performance over a multi-year period. These goals are accomplished by providing equity-based incentives focused on financial performance measures that: (i) have a historically high correlation to shareholder returns; (ii) are within management’s direct control; and (iii) encourage long-term commitment to delivering shareholder value. Long-term incentives have been granted under the shareholder-approved 2010 CSX Stock and Incentive Award Plan (the “2010 Stock Plan”) and 2019 Stock and Incentive Award Plan (the “2019 Stock“Stock Plan” and together with the 2010). The Stock Plan the “Stock Plans”).The Stock Plans allowallows for different types of equity-based awards and provideprovides flexibility in compensation designdesigned to attract, retain and engage high-performing executives. The Committee determines the mix of equity vehicles annually to ensure alignment with market practice, motivate appropriate long-term, results-driven behaviors, and align Company and NEO performance with shareholder interests and drive value creation.

Elements of Long-Term Incentive Compensation A significant portion of the NEOs’ target compensation is comprised of the Long-Term Incentive Plan (“LTIP”)(LTIP) awards. Each year, the Committee, as part of its annual review process, determines a market competitive long-term incentive target grant value for each NEO, which is then converted into the corresponding value of equity-based awards. For 2021,2023, the LTIP grants for the NEOs were comprised of performance units, restricted stock units and non-qualified stock options awards,and restricted stock units, which were designed to drive long-term value and growth through the achievement of Company performance goals and increased stock prices. The number of performance units and restricted stock units is determined based on the award value divided by the average closing value of CSX common stock for the full three-month period prior to the grant. The number of non-qualified stock options is determined based on the award value divided by the Black-Scholes value for that same period. The grants associated with each three-year cycle are reviewed and approved by the Committee each year for the NEOs and other eligible participants, and by the Board for the CEO. These grants are made and the performance targets are set following the annual Board review of the Company’s business plan for the applicable upcoming three-year period. Since the three-year performance cycles run concurrently, the Company may have up to three active LTIP cycles during a given year. For example, the 2019-20212021-2023 performance cycle closed on December 31, 2021,2023, and was paid out in January 2022.2024. The 2020 – 2022, 2021 – 20232022-2024, 2023-2025 and 2022 – 20242024-2026 cycles remain in progress, which helphelps ensure that our employees remain focused on sustainable long-term performance. Performance Units. Performance units are granted at the beginning of the applicable performance cycle, as described below. Awards are paid in the form of CSX common stock at the end of the performance period based on the level of achievement on Company performance goals. Performance units are generally subject to forfeiture if a participant’s employment terminates before the end of the performance cycle for any reason other than death, disability, retirement or other limited circumstances, as approved by the Committee. For the 2019 – 2021 LTIP cycle, upon death, disability or retirement, participants or their estates received a prorated portion of their award based on the number of months completed in the cycle. Beginning in 2020, upon death or disability, participants are eligible to earn the performance units that they would otherwise have earned at the end of the performance period had there been no death or disability. Upon retirement, participants receive a prorated portion of their award based on the number of months completed in the LTIP cycle. Mr. Foote is currently eligible for retirement for purposes

| | | | | | | | | | Long-Term Compensation Element | Description | Features | | | | | Performance Units | nPerformance units are granted at the beginning of the applicable performance cycle, as described below. nAwards are paid in the form of CSX common stock at the end of the performance period based on the level of achievement on Company performance goals. nParticipants also receive dividend equivalents at the end of the restricted period paid in the form of CSX common stock, assuming performance goals are met. | nPerformance units (and related dividend equivalents) are generally subject to forfeiture if a participant’s employment terminates before the end of the performance cycle for any reason other than death, disability, retirement or other limited circumstances, as approved by the Committee. nFor the 2021-2023 and 2022-2024 LTIP cycles, upon retirement—defined as (i) age 65 or (ii) age 55 plus 10 years of service—participants received a prorated portion of their award based on the number of months completed in the cycle. For the 2023-2025 and 2024-2026 LTIP cycles, upon retirement—defined as (i) age 65, (ii) age 60 plus five years of service or (iii) age 55 plus 12 years of service—all outstanding performance units will remain outstanding and eligible to vest based on Company performance through the end of the applicable LTIP cycle. To receive full vesting, NEOs must work through December 31st of the first year of the LTIP cycle and receive consent from the Committee. nThe employment letter for Mr. Hinrichs provides that, in connection with his retirement, all outstanding performance units will remain outstanding and eligible to vest based on Company performance through the end of the applicable LTIP cycle. Mr. Hinrichs will only receive the full vesting of his performance units in connection with retirement if he retires after reaching age 60 with five years of service. nUpon death or disability for all LTIP cycles, participants or their estates earn the performance units that they would otherwise have earned at the end of the performance period had there been no death or disability. nPerformance unit payouts for each LTIP cycle, if any, do not occur until approved by the Committee in January of the year following the conclusion of the three-year performance cycle. These payouts can vary from the target grants in terms of: (i) the number of shares paid out due to financial performance; and (ii) the market value of CSX common stock at the time of payout. nBased on actual performance, as discussed below, the performance unit payouts for the NEOs can range from 0% to 250% of the target levels, and can be of lesser or greater value than the original grant value based on the level of achievement on the performance goals and the price of CSX common stock. | | | |

Compensation Discussion and his employment agreement provides that, in connection with his retirement, his outstanding performance units will remain outstanding and eligible to vest based on Company performance through the end of the applicable LTIP cycle.Performance unit payouts for each LTIP cycle, if any, do not occur until approved by the Committee in January of the year following the conclusion of the three-year performance cycle. These payouts can vary from the target grants in terms of: (i) the number of shares paid out due to financial performance; and (ii) the market value of CSX common stock at the time of payout. Based on actual performance, as discussed below, the performance unit payouts for the NEOs can range from 0% to 250% of the target levels, and can be of lesser or greater value than the original grant value based on the level of achievement on the performance goals and the price of CSX common stock.

Analysis | Long-Term Incentive Compensation | 50 | | | | | | | | | Long-Term Compensation Element |  | Features | | | | | Non-qualified Stock Options | nNon-qualified stock options vest ratably over three years and require stock price appreciation to provide any value to the NEOs. nAs a result, they reinforce leadership’s focus on the importance of value creation for shareholders. Non-qualified stock options generally provide participants with the right to buy CSX stock at a pre-set price for a period of 10 years. nThe exercise price of the non-qualified stock options is established as the closing stock price on the date of grant. The Stock Plan prohibits the repricing of outstanding non-qualified stock options without the approval of shareholders. | nFor outstanding LTIP cycles, non-qualified stock options are subject to forfeiture if a participant’s employment terminates before the end of the vesting period for any reason other than death, disability, retirement or other limited circumstances, as approved by the Committee. nFor the 2021-2023 and 2022-2024 LTIP cycles, upon retirement—defined as (i) age 65 or (ii) age 55 plus 10 years of service—participants received a prorated portion of their award based on the number of months completed in the cycle. For the 2023-2025 and 2024-2026 LTIP cycles, upon retirement—defined as (i) age 65, (ii) age 60 plus five years of service or (iii) age 55 plus 12 years of service—all outstanding non-qualified stock options will remain outstanding and eligible to vest based on Company performance through the end of the applicable LTIP cycle. To receive full vesting, NEOs must work through December 31st of the first year of the LTIP cycle and receive consent from the Committee. nThe employment letter for Mr. Hinrichs provides that, in connection with his retirement, the full awards will continue to vest in accordance with their terms. Mr. Hinrichs will only receive the full vesting of his award in connection with retirement if he retires after reaching age 60 with five years of service. nUpon death or disability for all LTIP cycles, participants or their estates receive all options per the original vesting schedule as if there was no death or disability. | | | | | | | | Restricted Stock Units | nRestricted stock units are time-based awards that vest three years from the grant date (“the restricted period”) for the 2021-2023 and 2022-2024 LTIP cycles. nRestricted stock units for the 2023-2025 and 2024-2026 LTIP cycles are time-based awards that vest ratably over the three year period from the grant date. nAwards are paid in the form of CSX common stock at the end of the restricted period. Participants also receive dividend equivalents at the end of the restricted period paid in the form of CSX common stock. | nRestricted stock units are generally subject to forfeiture if a participant’s employment terminates before the end of the restricted period for any reason other than death, disability, retirement or other limited circumstances, as approved by the Committee. nFor the 2021-2023 and 2022-2024 LTIP cycles, upon retirement—defined as (i) age 65 or (ii) age 55 plus 10 years of service—participants received a prorated portion of their award based on the number of months completed in the cycle. For the 2023-2025 and 2024-2026 LTIP cycles, upon retirement—defined as (i) age 65, (ii) age 60 plus five years of service or (iii) age 55 plus 12 years of service—all outstanding restricted stock units will remain outstanding and eligible to vest based on Company performance through the end of the applicable LTIP cycle. To receive full vesting, NEOs must work through December 31st of the first year of the LTIP cycle and receive consent from the Committee. nThe employment letter for Mr. Hinrichs provides that, in connection with his retirement, the full awards will continue to vest in accordance with their terms. Mr. Hinrichs will only receive the full vesting of his award in connection with retirement if he retires after reaching age 60 with five years of service. nUpon death or disability for all LTIP cycles, participants or their estates receive all restricted stock units per the original vesting schedule as if there was no death or disability. | | | |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

Non-qualified Stock Options. Non-qualified stock options vest ratably over three years and require stock price appreciation to provide any value to the NEOs. As a result, they reinforce leadership’s focus on the importance of value creation for shareholders. Non-qualified stock options generally provide participants with the right to buy CSX stock at a pre-set price for a period of 10 years. The exercise price of the non-qualified stock options is established as the closing stock price on the date of grant. The Stock Plans prohibit the repricing of outstanding non-qualified stock options without the approval of shareholders. For outstanding LTIP cycles, non-qualified stock options are subject to forfeiture if a participant’s employment terminates before the end of the vesting period for any reason other than death, disability, retirement or other limited circumstances, as approved by the Committee. For the 2019 – 2021 LTIP cycle, upon death, disability or retirement, participants or their estates received a prorated portion of their award based on the number of months completed in the cycle. Beginning in 2020, all options will vest per the original vesting schedule in the case of death or disability. Upon retirement, participants will receive a prorated portion of the award based on the number of months completed in the cycle. The employment agreement for Mr. Foote provides that, in connection with his retirement, the full awards will continue to vest in accordance with their terms.

Restricted Stock Units. Restricted stock units are time-based awards that vest three years from the grant date (“the restricted period”). Awards are paid in the form of CSX common stock at the end of the restricted period. Restricted stock units are generally subject to forfeiture if a participant’s employment terminates before the end of the restricted period for any reason other than death, disability, retirement or other limited circumstances, as approved by the Committee. For the 2019 – 2021 LTIP cycle, upon death, disability or retirement, participants or their estates received a prorated portion of their award based on the number of months completed in the cycle. Beginning in 2020, all restricted stock units will vest per the original vesting schedule in the case of death or disability. Upon retirement, participants will receive a prorated portion of their award based on the number of months completed in the LTIP cycle. Mr. Foote is currently eligible for retirement for purposes of the LTIP and his employment agreement provides that, in connection with his retirement, his outstanding restricted stock units will remain outstanding and eligible to vest at the end of the restricted period for any outstanding LTIP cycles.

Further information regarding the LTIP grants made to our NEOs in 20212023 can be found under the “2021“2023 Grants of Plan-Based Awards Table” below. Table.”

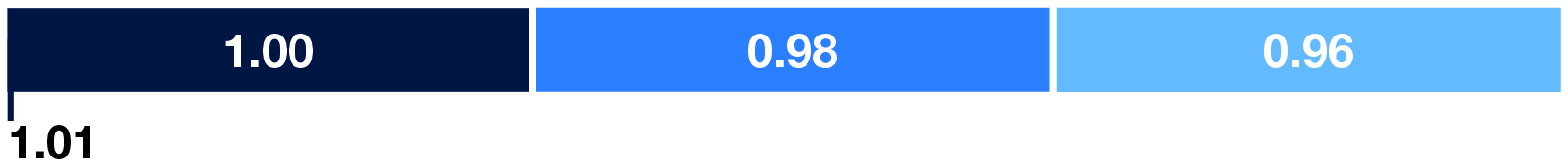

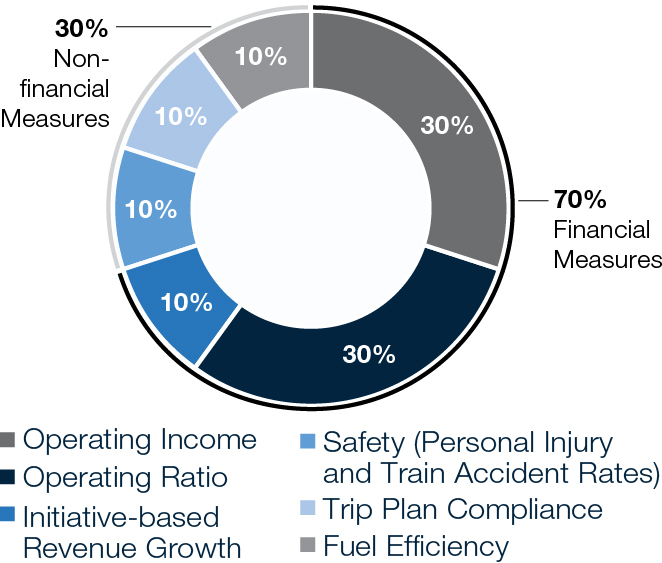

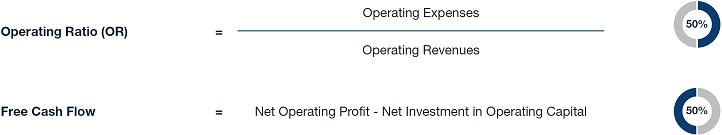

Compensation Discussion and Analysis | Long-Term Incentive Compensation Performance Measures and Financial Goals for the 2019 - 20212021-2023 LTIP For performance units granted under the 2019 – 20212021-2023 LTIP cycle, cumulativeaverage annual operating ratioincome growth rate and cumulative free cash flow were selected to measure the Company’s performance. Operating ratio hasAverage annual operating income growth rate measures the average increase in operating income over the three-year period and was chosen to replace operating income as a historically high correlationmeasure to align with the Company’s stock price and serves asobjective of profitable growth while also providing the ability to recover in the event of a key financial performance measure for CSX and the railroad industry. As such, the use of operating ratio has strengthened participants’ understanding of how they can impact Company performance and drive operating efficiency. Long-term improvements in operating ratio have increased operating income and earnings, creating value for shareholders.prolonged economic downturn. Free cash flow was chosen as a performance measure as it is a key measure of the financial health of the business, has a high correlation to shareholder returns and aligns with CSX’s financial business plan. Operating ratioAverage annual operating income growth rate and free cash flow were each weighted 50% of the total payout opportunity and were measured independently of the other.

| | | | | | | | | | | | | | | | Average Annual Operating Income Growth Rate | = | Straight Average of Year-over-Year Change in

[Operating Revenues – Operating Expenses] | | | | Free Cash Flow* | = | Net Operating Profit – Net Investment in Operating Capital | | |

* Free cash flow is a non-GAAP measure calculated by using net cash provided by operating activities and adjusting for property additions and proceeds and advances from property dispositions. Free cash flow represents cash available for both equity and bond investors to be used for dividends, share repurchases or principal reduction on outstanding debt. The threshold, target and maximum payouts for each measure are 10%25%, 50% and 100% of the performance units subject to the award respectively, generating a total target payout of 100% of the performance units and a maximum possible payout of 200% of the performance units for the 2019 – 20212021-2023 LTIP. The 2019 – 20212021-2023 LTIP measured average annual operating ratioincome growth rate and free cash flow over a 12-quarter period from January 20192021 through December 2021.2023. In addition to average annual operating ratioincome growth rate and free cash flow, the performance units for thisthe 2021-2023 LTIP cycle for the President and Chief Executive Officer and all Executive Vice Presidents had a formulaic linear upward or downward relative total shareholder return (“Relative TSR”) modifier of up to 25% (subject to the 250% overall cap) based on CSX’s stock price performance compared to the peer group (weighted 80% core peers and 20% additional correlated companies)(S&P 500 Industrials Index) for the 12-quarter period from January 20192021 through December 2021. This2023. In June 2021, Mr. Pelkey assumed the role of Vice President and Acting Chief Financial Officer. As such, the modifier only applied to the performance units he received on June 4, 2021 in relation to his new role and responsibilities. The modifier did not apply to the LTIP performance units granted to Mr. Pelkey for this LTIP cycleon February 9, 2021 as he was not promoted to Executive Vice President until January 2022.The Committee recognizes that operating ratio is a measure in the short– Finance and long-term plans, but believes inclusion in both plans reflects the criticality of the alignment between operating ratio and the Company’s focus on operating efficiency. The Committee does not believe this overlap will create inappropriate risk-taking since the measurement periods are different (one vs. three years), and operational measures and reviews are in place to monitor risk. The Committee annually reviews the measures used for each long-term incentive cycle, and makes changes as appropriate. This overlap was eliminated starting with the 2020 – 2022 LTIP consistent with CSX’s strategic initiatives focused on growth.

2022 Proxy Statement 51

Treasury.Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

Financial Goals for the 2019 - 2021 LTIP

The LTIP targets for the performance units granted under the 2019 – 20212021-2023 LTIP were set in February 2019,2021, based on the three-yearthree-year business plan at the time of its adoption. The targets under the 2019-2021 LTIP were as follows: | Cumulative Operating Ratio (100% maximum payout) | | Cumulative Free Cash Flow (100% maximum payout) | Threshold

(10% payout) | | Target

(50% payout) | | Maximum

(100% payout) | | Threshold

(10% payout) | | Target

(50% payout) | | Maximum

(100% payout) | | 60.0% | | 59.0% | | 58.0% | | $9.0B | | $9.725B | | $10.325B |

At the time the 2019 – 2021 LTIP was approved by the Committee, a provision was made for the adjustment of the operating ratio performance goals by a pre-determined amount if the average cost of highway diesel fuel was outside the range of $2.85 - $3.35 per gallon. This potential adjustment is designed to mitigate the positive

Compensation Discussion and negative impact volatile fuel prices may have on expenses and operating ratio. There was no adjustment to the cumulative operating ratio targets as the average price per gallon of highway diesel fuel of $2.96 was within the range of $2.85 – $3.35 per gallon, which was the collar set at the time of adoption of the plan.Analysis | Long-Term Incentive Compensation Payout for the 2019 - 20212021-2023 LTIP Performance Units Based on a cumulativean average annual operating ratioincome growth of 57.4%9.4% and a cumulative free cash flow of $9.96$10.745 billion for the cycle, the payoutachievement for the performance units, which comprised 60%50% of the 2019 – 20212021-2023 LTIP, was 169%200% of the target. TheAs shown in the table below, the Company’s Relative TSR performance against the peer group was below median for the cycle, resulting in a downward modifier of 15%19% against target performance and an aggregate downward modifier of 38%, and asuch that the total payout of 144%achievement was 162% for each of the NEOs other than Mr. Pelkey. Since Mr. Pelkey who was not an Executive Vice President at the time of the grant on February 9, 2021, the modifier did not apply and he received a total payout of 200%. Mr. Pelkey was also granted performance units on June 4, 2021 in connection with his promotion to his role as Vice President and Acting Chief Financial Officer. He received a total payout inclusive of December 31, 2021.

the modifier of 162% for this award.  * Free cash flow is a non-GAAP measure calculated by using net cash provided by operating activities and adjusting for property additions and proceeds and advances from property dispositions. Free cash flow represents cash available for both equity and bond investors to be used for dividends, share repurchases or principal reduction on outstanding debt. | | | | | | | | | | | | | | | | | | | Threshold

(25% payout) | Target

(50% payout) | Maximum

(100% payout) | | Payout | | Average Annual Operating Income Growth Rate (50% weighting) | | 200% of Target | | Cumulative Free Cash Flow* (50% weighting) | | | Relative TSR (Modifier) | | -19% | | Total Payout: | | | | | 162% of Target |

* Free cash flow is a non-GAAP measure calculated by using net cash provided by operating activities and adjusting for property additions and proceeds and advances from property dispositions. Free cash flow represents cash available for both equity and bond investors to be used for dividends, share repurchases or principal reduction on outstanding debt.

Compensation Discussion and Analysis | Long-Term Incentive Compensation Performance Measures and Equity Award Mix for the Outstanding LTIPs Performance Measures. In determining the performance measures for the performance units for each LTIP cycle, the Committee: (i) considers information on various growth and return-based measures; and (ii) actively monitors the effectiveness of existing measures in driving the Company’s strategic business objectives and delivering shareholder returns. For performance units, the 2020 – 2022 LTIP uses operating income | | | | | | | | | | LTIP Cycle | Performance Measures | Rationale | | | | | | | | 2022-2024, 2023-2025 and 2024-2026 LTIP cycles | nAverage Annual Operating Income Growth Rate (50%) nEconomic Profit (CCE) (50%) | nContinued the Company’s focus on driving profitable growth. nEconomic Profit (CCE) is a non-GAAP financial measure designed to measure whether returns on new investments exceed an expected rate of return and to encourage investments in profitable growth projects. Improvement in Economic Profit (CCE) has historically had a strong relationship to stock price appreciation. nAs shown below, Economic Profit (CCE) is calculated as gross cash earnings minus the capital charge on gross operating assets, and Economic Profit (CCE) performance is measured as an improvement versus the prior year’s actual Economic Profit (CCE). nAn Economic Profit (CCE) payout percentage is calculated for each fiscal year during the LTIP cycle, with the final payout percentage determined using an average of the three annual payout percentages. nThis measure was incorporated to drive earnings growth, and to better align compensation to the ONE CSX strategy and to the value created for our shareholders and other stakeholders. nForward-looking LTIP targets are not disclosed for proprietary and competitive harm reasons. | | | | | | | | | | | | | |

Compensation Discussion and free cash flow on an equally weighted basis to measure the Company’s performance. The 2021 – 2023 LTIP uses average annual operating income growth rate percentage and free cash flow on an equally weighted basis, as the performance measures for the performance units. The average annual operating income growth rate percentage measure aligns with the Company’s objective of profitable growth and provides the ability to recover and potentially receive a payout in the event of an economic downturn in one year of the program. For the 2022 – 2024 LTIP, the Committee approved the use of average annual operating income growth rate percentage and CSX cash earnings (“CCE”) on an equally weighted basis, as the performance measures for the performance units. CCE is designed to measure whether returns on new investments exceed an expected rate of return and to encourage investments in growth projects. This measure was incorporated to drive earnings growth and better align compensation to the One-CSX strategy. Historically, CCE has had a high correlation to stock price appreciation. The changes in performance measures for the performance units have been designed to reward long-term performance during a period of transformation and change, and to focus on the Company’s strategic initiatives to drive growth.52 |  |

Analysis | Long-Term Incentive Compensation Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

The 2020 – 2022 LTIP is comprised of performance units and non-qualified stock options for the NEOs, and the 2021 – 2023 and 2022 –2024Equity Mix. All three outstanding LTIPs are comprised of performance units, non-qualified stock options and restricted stock units. The number of performance units and restricted stock units awarded to each NEO is calculated based on a specific grant value divided by the average closing price of CSX common stock for the full three-month period prior to the grant. The number of options awarded is calculated based on the Black-Scholes value for the same period.NEOs. For the 2020 – 20222022-2024 LTIP, the Committee approved a market competitive LTIP grant value for the NEOs (the Board approved for the CEO) allocating 50% of the value to performance units, and 50%25% for non-qualified stock options. The allocation for the 2021 – 2023 and 2022 – 2024 LTIPs was 50% performance units, 25% restricted stock units and 25% for non-qualified stock options. The allocation for the 2023-2025 and 2024-2026 LTIPs was 60% performance units, 20% restricted stock units and 20% non-qualified stock options, to address shareholder concerns of additional performance orientation in the Company’s long-term incentive plan.

| | | | | | | | | | | | | | | | | | | n | | n | | n | | | Performance Units | Restricted Stock Units | Non-qualified Stock Options |

| | | | 2023-2025 and 2024-2026 LTIPs |

| | | | | | | | | | | | | | | | | | | n | | n | | n | | | Performance Units | Restricted Stock Units | Non-qualified Stock Options |

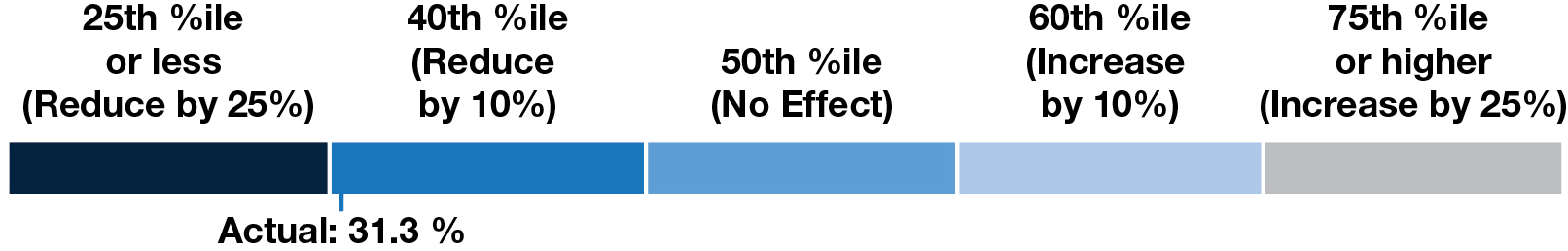

The performance units for these threethe 2022-2024 and 2023-2025 LTIP cycles have a formulaic linear upward or downward Relative TSR modifier of up to 25% with a maximum payout of 250%, which applies only to the CEO and Executive Vice Presidents. The performance units for the 2024-2026 LTIP cycle have a Relative TSR modifier that recognizes over performance above the 60th percentile and under performance below the 40th percentile with a maximum payout of 250%. Performance between the 61st and 75th percentiles and above would result in an increased payout by up to 25%, and performance between the 25th and 39th percentiles and below would result in a decreased payout by up to 25%. Performance between the 40th and 60th percentiles would result in no modification to payouts. This modifier is designed to appropriately align NEO payouts with share price performance relative to a transportation-relatedpredetermined peer group. This modifier does not applygroup, as approved by the Committee at the time of grant. For the 2022-2024 LTIP, the number of performance units and restricted stock units awarded to Mr. Pelkeyeach NEO was calculated based on a specific grant value divided by the average closing price of CSX common stock for the 2020 – 2022full three-month period prior to the month of grant, and 2021 – 2023the number of options awarded was calculated based on the Black-Scholes value for the same period. For the 2023-2025 LTIP, cycles, as hethe number of performance units and restricted stock units awarded to each NEO was not promotedcalculated based on a specific grant value divided by the average closing price of CSX common stock for the 30-trading-day period preceding the date of the grant. The number of options awarded was calculated based on the Black-Scholes value for the same period. The number of performance units and restricted stock units awarded to Executive Vice President until January 2022.each NEO for the 2024-2026 LTIP was calculated based on a specific grant value divided by the grant date closing price of CSX common stock. The number of options awarded was calculated based on the Black-Scholes value for the same period. Clawback ProvisionProvisions and Policy Payouts made under the MICP and LTIP programs are subject to recovery or clawback in certain circumstances. Under the applicable clawback provisions, an employee who has received a payout will be required to promptly return the monies (or any portion of the monies requested by the Company) in each of the following circumstances: (i) if it is determined that the employee engaged in misconduct, including, but not limited to, dishonesty, fraud (including reporting inaccurate financial information), theft or other serious misconduct as determined by the Company; (ii) if the Company is required to file an accounting restatement due to the Company’s material noncompliance with any financial reporting requirements under the federal securities laws; or (iii) if the payout is otherwise required to be recovered by law or court order (i.e. , garnishment).